By Omkar Godbole (All times ET unless indicated otherwise)

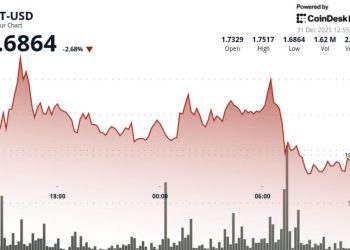

(Bitcoin) has dropped to $90,000, with the broader market following suit. The CoinDesk 20 (CD20) and CoinDesk 80 (CD80) indices are down over 3.5% each on a 24-hour basis.

The weakness is consistent with the dour mood in Nasdaq futures triggered by Oracle’s earnings miss, and follows a 25 bps Fed rate cut. Traders said the hawkish forward guidance, projecting just one rate cut in 2026 and the growing divide among policymakers, overshadowed easing and pushed risk assets lower.

Some analysts said that with the last major event done and implied volatility falling, a big rally into year-end may not happen. Moreover, flows to ETFs would not need to pick up substantially for prices to surge.

Consider this: We have not had a single day of over $500 million in net spot ETF inflows in the U.S. since Nov. 11, according to data source SoSoValue. Prior to that, the last was on Oct. 7. This is a marked slowdown compared to November-December 2024, when the ETFs collected that much at least one or two days per week.

The same can be said for the April to October period, also characterized by an upswing in BTC from $70,000 to over $126,000.

In short, flows are king and it remains to be seen if they meaningfully recover in the days ahead to lift prices into the new year.

For now, here is some positive news: According to BRN, large holders (10–10k BTC wallets) have added roughly 42,565 BTC since Dec. 1, a clear smart-money accumulation signal. Meanwhile, short-term holders and retail are still trimming positions.

In other key news, Ethereum co-founder Vitalik Buterin has thrown his weight behind Fileverse, a decentralized, open-source encrypted document platform that aims to be a Web3-native alternative to tools like Google Docs.

In a note on X, he said the project has spent the past few months fixing a series of bugs and is now stable enough for secure document sharing, commenting, and collaboration “without further issues.”

In traditional markets, the 10-year U.S. Treasury yield recovered from the post-Fed low of 4.11% to 4.14%, once again showing stickiness on the higher side. ING analysts have said that it’s likely to rally sustainably than drop.

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Dec. 11, 11 a.m.: Terraform Labs co-founder Do Kwon, who pleaded guilty in August to U.S. conspiracy and wire fraud charges, faces sentencing in New York by Judge Paul Engelmayer. Prosecutors seek up to 12 years, defense requests five.

- Dec. 11, 3 p.m.: Chia (XCH) AMA on Zoom.

- Dec. 11: 21Shares Core XRP Trust (TOXR) remains pending launch on Cboe BZX Exchange following Cboe’s listing approval on Dec. 10; no confirmed first-trade date yet.

- Macro

- Dec. 11, 8:30 a.m.: U.S. Initial Jobless Claims for week ended Dec. 6 Est. 220K, U.S. Continuing Jobless Claims for week ended Nov. 29 Est. 1950K.

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Arbitrum DAO is voting on a one-year initiative funded by the existing DIP budget to financially reward delegates with over 200k ARB who vote consistently and publish their reasoning. Voting ends Dec. 11.

- Dec. 11: Worldcoin to host an “unwrapped” livestream.

- Unlocks

- Token Launches

- Dec. 11: Talus Network (US) to be listed on Kraken, Gate.io, BitMart, Bitget, KuCoin, and others.

- Dec. 11: Stable (STABLE) to be listed on Bithumb.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 2.3% from 4 p.m. ET Wednesday at $90,263.13 (24hrs: -2.24%)

- ETH is down 4.25% at $3,199.17 (24hrs: -3.71%)

- CoinDesk 20 is down 3.25% at 2,871.54 (24hrs: -3.85%)

- Ether CESR Composite Staking Rate is down 1 bps at 2.8%

- BTC funding rate is at 0.0026% (2.8021% annualized) on Binance

- DXY is down 0.2% at 98.59

- Gold futures are up 0.47% at $4,244.40

- Silver futures are up 2.53% at $62.58

- Nikkei 225 closed down 0.90% at 50,148.82

- Hang Seng closed down 0.04% at 25,530.51

- FTSE is up 0.11% at 9,666.02

- Euro Stoxx 50 is up 0.19% at 5,718.99

- DJIA closed on Wednesday up 1.05% at 48,057.75

- S&P 500 closed up 0.67% at 6,886.68

- Nasdaq Composite closed up 0.33% at 23,654.16

- S&P/TSX Composite closed up 0.79% at 31,490.85

- S&P 40 Latin America closed down 0.2% at 3,129.59

- U.S. 10-Year Treasury rate is down 1.9 bps at 4.145%

- E-mini S&P 500 futures are down 0.54% at 6,854.50

- E-mini Nasdaq-100 futures are down 0.77% at 25,599.75

- E-mini Dow Jones Industrial Average Index futures are down 0.18% at 48,019.00

Bitcoin Stats

- BTC Dominance: 59.26% (0.27%)

- Ether-bitcoin ratio: 0.03539 (-2.04%)

- Hashrate (seven-day moving average): 1,066 EH/s

- Hashprice (spot): $38.52

- Total fees: 2.69 BTC / $248,636

- CME Futures Open Interest: 126,970 BTC

- BTC priced in gold: 21.4 oz.

- BTC vs gold market cap: 6.05%

Technical Analysis

- The chart shows BTC’s daily price swings in candlestick format since September.

- Wednesday’s Fed rate cut hasn’t changed the technical picture, as BTC remains stuck in a counter-trend rising channel within the broader downtrend.

- A clear breakout above the upper end of the counter trend channel would signal a bearish-to-bullish trend change.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $275.09 (-0.82%), -2% at $269.59 in pre-market

- Circle (CRCL): closed at $88.41 (+2.78%), -2.3% at $86.38

- Galaxy Digital (GLXY): closed at $29.52 (+0.24%), -2.1% at $28.90

- Bullish (BLSH): closed at $46.13 (+0.04%), -2.28%% at $45.08

- MARA Holdings (MARA): closed at $11.92 (-2.69%), -2.18% at $11.66

- Riot Platforms (RIOT): closed at $15.57 (+0.39%), -1.93% at $15.27

- Core Scientific (CORZ): closed at $17.33 (-0.91%), -1.27% at $17.11

- CleanSpark (CLSK): closed at $14.53 (-2.15%), -2.89% at $14.11

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.91 (-3.20%), -2.16% at $44.92

- Exodus Movement (EXOD): closed at $15.73 (+2.95%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $184.64 (-2.3%), -2.43% at $180.15

- Semler Scientific (SMLR): closed at $20.35 (-0.1%)

- SharpLink Gaming (SBET): closed at $12.02 (+3.62%), -3.14% at $11.41

- Upexi (UPXI): closed at $2.45 (-4.3%)

- Lite Strategy (LITS): closed at $1.84 (+0.55%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $223.5 million

- Cumulative net flows: $57.91 billion

- Total BTC holdings ~ 1.30 million

Spot ETH ETFs

- Daily net flow: $57.6 million

- Cumulative net flows: $13.17 billion

- Total ETH holdings ~ 6.31 million

Source: Farside Investors