- Crypto funds logged $1.17B outflows, extending losses amid weak sentiment and rate cut uncertainty.

- Bitcoin and Ether led the decline, while short Bitcoin ETPs saw strongest inflows since May 2025.

- Solana, XRP, and Hedera posted inflows, bucking the trend as crypto ETP assets fell to $207.5B.

Cryptocurrency investment products faced mounting selling pressure last week, marking a second consecutive week of capital outflows as investors continued to react to broader market weakness and shifting macroeconomic sentiment.

According to a Monday report from CoinShares, crypto exchange-traded products (ETPs) recorded $1.17 billion in outflows for the week, a sharp increase of about 70% from the $360 million withdrawn the previous week.

The trend underscores the growing caution among digital asset investors amid ongoing volatility and uncertainty surrounding U.S. monetary policy.

Negative sentiment deepens after flash crash

James Butterfill, head of research at CoinShares, attributed the sustained sell-off to persistent negative sentiment across crypto markets following the October 10 flash crash.

He also pointed to investor uncertainty over whether the Federal Reserve might cut interest rates in December, which has added another layer of hesitation among market participants.

Despite the outflows, trading activity remained high.

CoinShares reported that ETP trading volumes stayed elevated at $43 billion for the week, indicating that investors are still actively repositioning amid the volatility.

There was a brief recovery midweek, with optimism building on Thursday as traders grew hopeful that progress on averting the US government shutdown could stabilize risk sentiment.

However, those hopes faded quickly, and renewed outflows returned by Friday, Butterfill noted.

Bitcoin and Ether lead outflows

Bitcoin continued to bear the brunt of the selling pressure.

Bitcoin ETPs saw $932 million in outflows, only marginally lower than the $946 million recorded in the previous week.

The world’s largest cryptocurrency has been struggling to regain positive momentum since early October, reflecting broader investor caution.

Ether (ETH) products also failed to hold their ground, reversing prior gains.

After recording $57 million in inflows the previous week, Ether funds posted $438 million in outflows, signaling that investors are not yet confident in the asset’s near-term performance.

Even short Bitcoin ETPs which benefit from declines in Bitcoin’s price, recorded $11.8 million in inflows, marking the strongest week for bearish Bitcoin products since May 2025.

Butterfill noted that this renewed interest in short positions underscores the deepening pessimism across digital asset markets.

Solana, XRP show resilience

Amid the broader downturn, a handful of altcoins managed to defy the selling trend.

Solana (SOL) stood out once again, attracting $118 million in inflows over the week.

According to CoinShares, Solana ETPs have now amassed $2.1 billion in inflows over the past nine weeks, highlighting sustained institutional interest in the blockchain network despite overall market weakness.

Other altcoins also showed resilience.

XRP (XRP) recorded $28 million in inflows, Hedera (HBAR) drew $27 million, and Hyperliquid (HYPE) added $4.2 million.

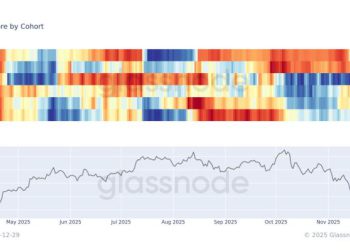

Overall, after two consecutive weeks of outflows totaling $1.5 billion, total assets under management (AUM) in crypto ETPs dropped to $207.5 billion, the lowest level since mid-July.

AUM had peaked at over $254 billion in early October, underscoring how quickly investor sentiment has shifted as macro and market headwinds continue to weigh on the digital asset sector.