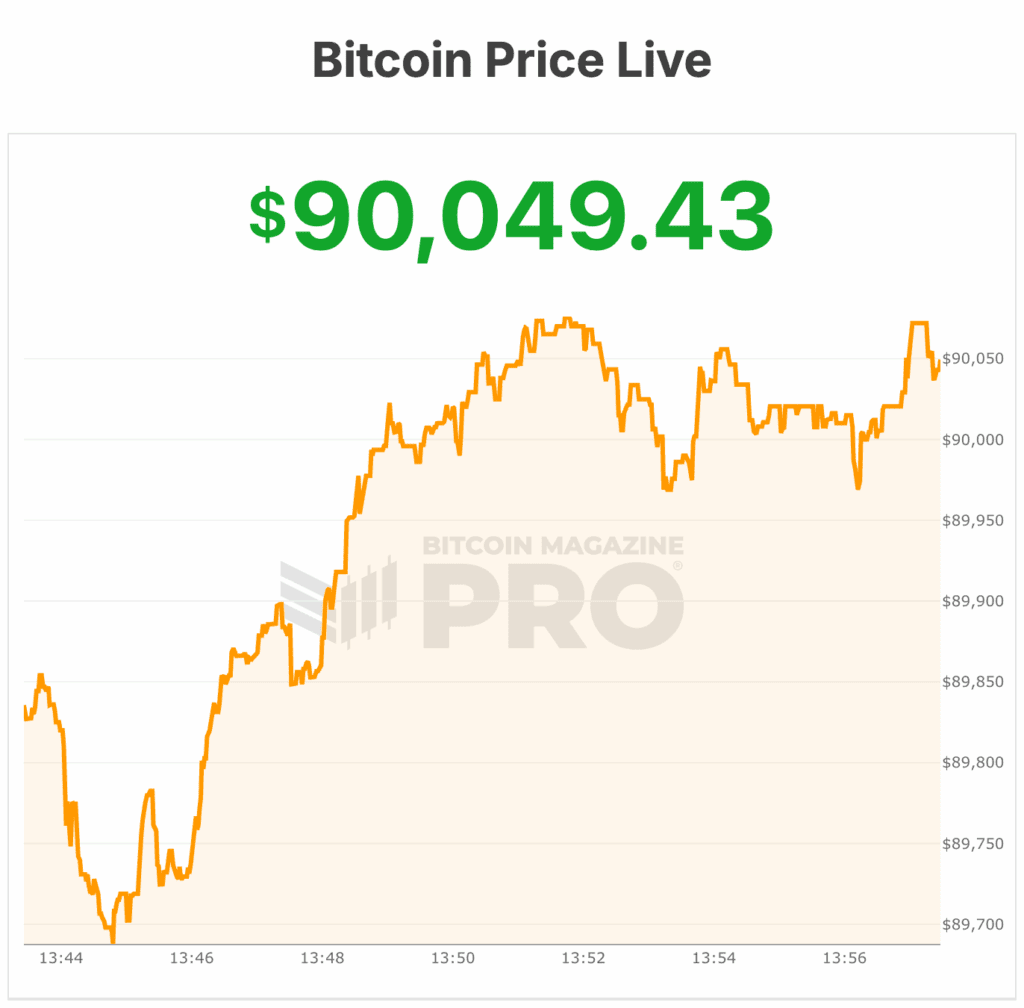

Bitcoin price ripped higher above $90,000 on Wednesday, extending a sharp rally fueled by accelerating institutional demand and a new wave of Wall Street–engineered crypto products.

The surge followed fresh disclosures showing BlackRock increasing its exposure to its own spot Bitcoin ETF, and JPMorgan pitching a complex, high-stakes structured note tied directly to BlackRock’s IBIT fund.

Bitcoin price touched 24-hour lows of $86,129 before rebounding above $90,300, continuing a volatile upswing that has defined the fourth quarter.

BlackRock’s latest regulatory filing shows the Strategic Income Opportunities Portfolio now holds 2,397,423 shares of IBIT, valued at $155.8 million as of September 30. That’s up 14% from June, when the fund reported 2,096,447 shares.

The steady buildup underscores how the world’s largest asset manager is using its internal portfolios to deepen its Bitcoin-linked positions.

The moves arrive as demand for structured crypto-linked investments heats up among major banks. JPMorgan’s newly proposed derivative-style note gives institutional clients a way to bet on the future price of Bitcoin through IBIT, currently the largest Bitcoin ETF with nearly $70 billion in assets.

The product is unusual — and aggressive. The note sets a price for IBIT next month. If, one year from now, IBIT trades at or above that price, the note is automatically called and investors collect a fixed 16% return.

If IBIT trades below the set level in a year, investors stay in the product until 2028. Should IBIT exceed JPMorgan’s next target price by then, investors earn 1.5x their investment with no upside cap. If the Bitcoin price skyrockets, the payouts follow.

There’s downside protection, too. If IBIT finishes 2028 down no more than 30%, investors receive their full principal back. But if the ETF falls more than 30%, losses match IBIT’s decline.

The structure combines a bond-like wrapper with derivatives exposure, a formula FINRA classifies broadly under its “structured note” category. These notes blend a traditional security with options-based payouts tied to a reference asset — in this case BlackRock’s Bitcoin ETF.

The pitch to institutions is simple: predictable returns if Bitcoin price stalls next year, leveraged upside through 2028, and limited long-term downside. The tradeoff is equally clear: no interest payments, no FDIC insurance, and the risk of losing most or all principal.

Reporting from The Block helped with this article.

Bitcoin price volatility

JPMorgan is explicit about the stakes. Its prospectus warns that investors “should be willing to lose a significant portion or all of their principal amount at maturity.” Volatility in Bitcoin, it adds, may be extreme, and the notes remain unsecured obligations of the bank.

The bank’s latest move also highlights an ongoing shift in Wall Street’s tone toward Bitcoin. CEO Jamie Dimon once mocked Bitcoin as “worse than tulip bulbs.” Yet JPMorgan is now engineering products that depend on the digital asset’s long-term trajectory.

Morgan Stanley has been exploring similar territory. Its own IBIT-linked structured note drew $104 million last month. The bank’s two-year “dual directional autocallable” product offers enhanced payouts if IBIT rises or stays flat, and modest gains if it falls up to 25%. But once losses exceed that level, investors take the hit with no cushion.

Analysts say these products reflect a revival in the structured-notes market. Bloomberg reported the sector is recovering from a decade-long slump after the collapse of Lehman Brothers wiped out billions tied to similar instruments.

The bitcoin price has fallen more than 30% from its October all-time high, slipping to around $87,000 as a nearly two-month drawdown keeps markets on edge. Mid-tier whale wallets holding 100+ BTC are ticking higher — a potential sign of bargain hunting — but larger whale cohorts continue to offload, contributing to weakened spot demand.

Analysts warn that the key $80,000–$83,000 support zone is being tested repeatedly, while Citi says the market lacks the inflows needed to stabilize prices.

At the time of writing, the bitcoin price is $90,049.