- BONK ETP launches on SIX, giving European investors regulated access to the crypto.

- BONK price jumps by 3.5%, outperforming broader crypto amid technical rebound.

- Institutional demand may boost liquidity and tighten the circulating supply.

Swiss crypto ETP provider Bitcoin Capital has launched a regulated exchange-traded product (ETP) for the Solana-based meme coin BONK on Switzerland’s SIX Swiss Exchange.

This marks a major milestone for the memecoin as the ETP helps it to enter one of Europe’s largest and most established financial markets.

Expanding access to meme coins

The BONK ETP provides a bridge between the cryptocurrency community and traditional financial investors.

By creating a regulated vehicle, Bitcoin Capital makes it possible for those unfamiliar with crypto exchanges to participate in the meme coin ecosystem while benefiting from the oversight and credibility that comes with a listed product.

Marcel Niederberger, CEO of Bitcoin Capital and FiCAS AG, highlighted Switzerland’s regulatory framework and the SIX Exchange’s infrastructure as key factors in choosing the venue.

According to Niederberger, the combination of consistent supervision and developed market structures positions Switzerland as an ideal hub for launching digital asset ETPs.

For the broader crypto market, BONK’s ETP represents another step in the gradual institutionalisation of meme coins.

While Dogecoin (DOGE) has dominated the conversation in regulated markets, with ETFs and leveraged products appearing on US exchanges, BONK’s introduction to Europe reflects an appetite for thematic and community-driven digital assets.

Bitcoin Capital anticipates further expansion of regulated products referencing BONK in the coming year, including additional ETPs and structured notes, as European investors increasingly embrace digital assets within conventional investment frameworks.

Regulatory legitimacy for BONK

By bringing BONK to regulated platforms, Bitcoin Capital is opening a new chapter in the evolution of meme coins, demonstrating how niche tokens can gain legitimacy while maintaining a connection to their communities.

Notably, the Swiss crypto ETP provider will lock the underlying BONK tokens in the ETP, tightening the circulating supply and providing a level of certainty for investors often absent in purely digital markets.

This structure is expected to enhance investor confidence and attract capital from institutional desks, which historically account for the majority of inflows in Bitcoin Capital’s products.

By integrating BONK into a regulated environment, the product demonstrates that meme coins can transcend their origins as internet-driven tokens to become credible investment vehicles.

The timing of the launch is particularly noteworthy given the rapid growth of digital asset products across Europe and the United States.

Recent months have seen a surge in memecoin ETFs and structured products, including offerings tied to Dogecoin, highlighting a global trend toward regulated exposure to popular cryptocurrencies.

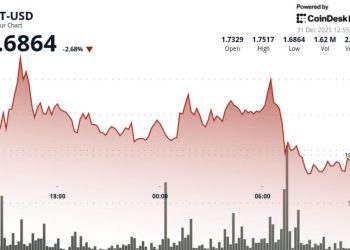

Following the Bonk ETP launch, the BONK price has jumped 3.5%, outperforming the broader crypto market, which rose around 2.84% today.

At press time, BONK memecoin was trading at $0.0599, and technical signals hint at a possible bullish trend, with BONK’s price reclaiming key moving averages and the RSI exiting oversold territory.