The crypto sector has been freed from its annual reference in the Financial Stability Oversight Council’s litany of financial risks posed to the U.S. system, though it’s not unique in that, because the report has effectively removed much of its focus on “vulnerabilities” to the financial system.

The FSOC, established after the 2008 mortgage meltdown that crashed the global economy, was meant to be an early-warning effort in which the council of regulatory chiefs tries to collectively spot dangers coming down the road. The digital assets industry was an annual item on that list, though the reports always noted the still-limited market size while suggesting that products such as stablecoins and exchange-traded funds could pose risks if the space got overly interconnected with the rest of the financial system. That’s no longer an explicit concern in the 2025 report released on Thursday by President Donald Trump’s regulators.

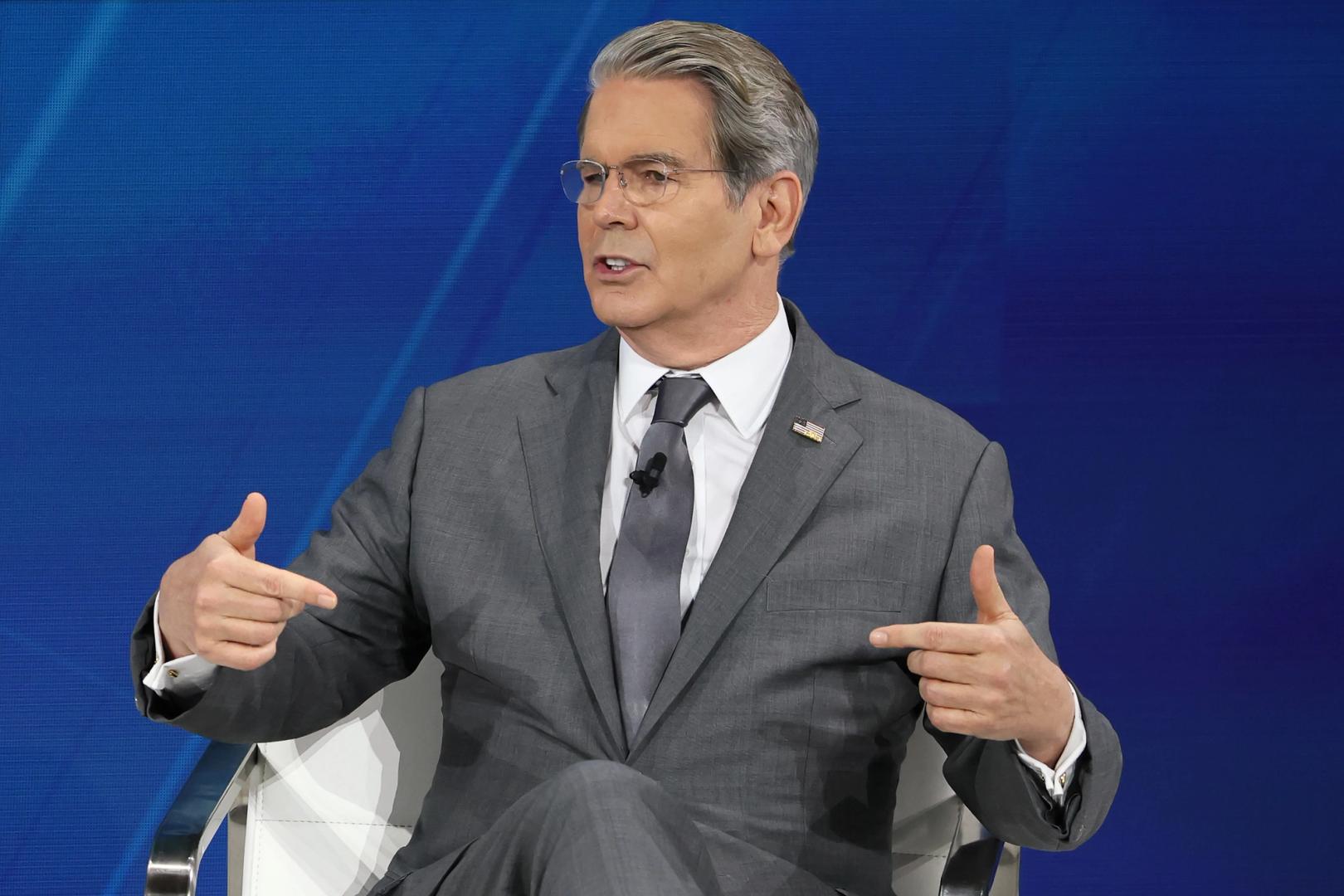

The document’s table of contents has entirely erased the once-ubiquitous word “vulnerabilities,” and Treasury Secretary Scott Bessent acknowledged in the report’s opening letter that the analysis historically focused on identifying dangers that could disrupt the financial system.

“But monitoring and addressing these vulnerabilities, although important, is not sufficient for safeguarding financial stability,” he contended. “Financial stability also requires and is interdependent with sustainable long-term economic growth and economic security.”

The 2024 report, a 140-page document written under the watch of regulators in the administration of former President Joe Biden, had mostly focused its digital assets recommendations on nudging Congress to regulate stablecoins and to assign specific regulation on the spot markets. This year’s shorter, 87-page report doesn’t include digital assets “recommendations” or flag explicit worries about the industry.

Under the digital assets section, it has a “further actions” subsection that refers to this year’s President’s Working Group report on U.S. crypto activity and the administration’s agenda, noting that previous report “contains recommendations for Congress and various government agencies, including certain council member agencies, to enable innovation and American leadership in digital financial technology.”

The 2025 FSOC report’s digital assets sections detailed how U.S. financial regulators with a say over crypto matters withdrew their previous policy stance in which they generally cautioned regulated financial firms with the risks of getting involved in the industry and sometimes stood in the way. It mostly praises the strengths of the growing sector, though it notes in the “illicit finance” subsection that stablecoins may be “abused to facilitate illicit finance transactions.”

However, it also said that the “continued use of U.S. dollar-denominated stablecoins is expected to support the role of the U.S. dollar in the international financial system over the next decade.”

Read More: FSOC’s Still Worried About Stablecoins