Bitcoin Price Weekly Outlook

Bitcoin price is looking lethargic heading into this week. Last week saw prices reject once again from the $94,000 resistance level. The bulls were not able to gain any momentum whatsoever as the price bled down into Sunday to close at $88,170. This week, the bears will look to break the $84,000 support level and take the price into the low $70,000 range. The bulls will desperately try to hold onto this $84,000 level as support, but it may not be able to survive another test.

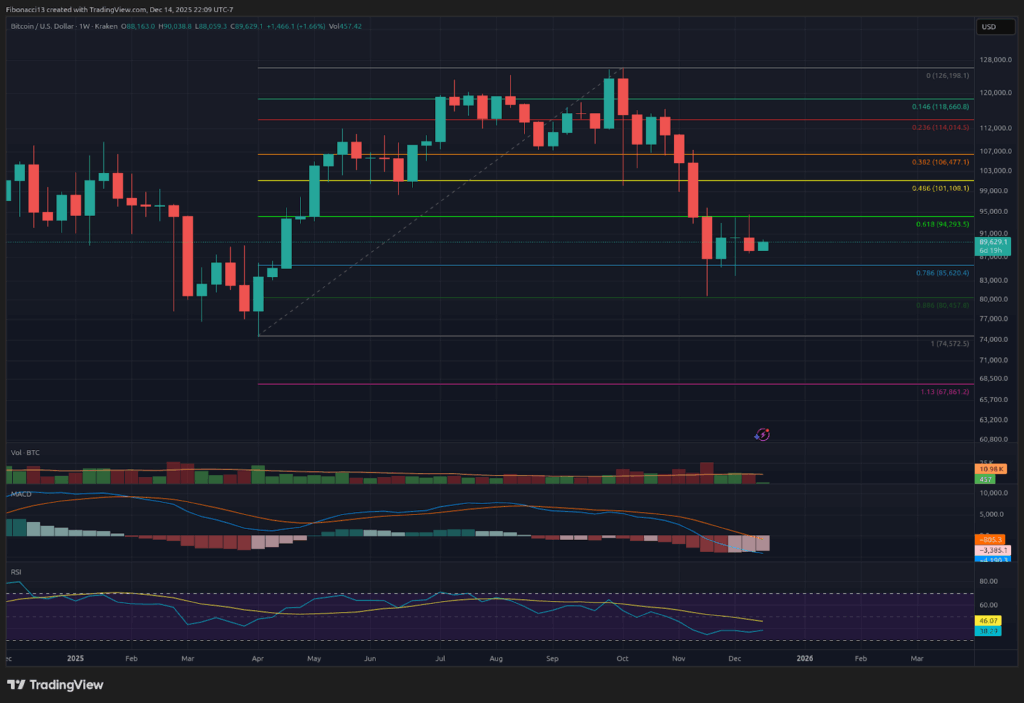

Key Support and Resistance Levels Now

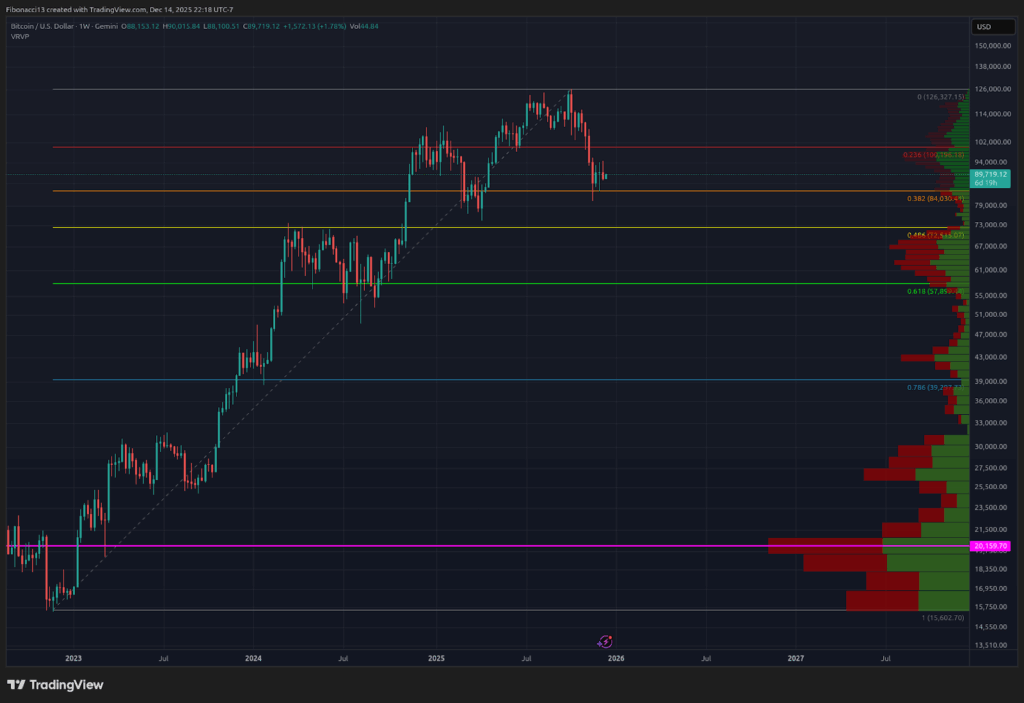

With the $84,000 support level again under pressure this week, the bears will look to finally drive the price down below it. There’s a small chance bulls may be able to defend $85,000, but it’s unlikely to hold here unless we see big buying volume step in. The $72,000 to $68,000 support zone below should be a solid floor on initial tests, so it would likely take a few weeks to break down through this level if we get there. Below here, bulls will look to hang onto the 0.618 Fibonacci retracement support at $57,000.

Up higher, we have a blanket of resistance now from $94,000 all the way up to $118,000. If bulls can manage to finally conquer $94,000, they will look to $101,000 next, although sellers should step in strongly above $97,000. Above $101,000, it should be a slow go all the way to $107,000. Even more buying pressure would be necessary above $107,000 to push through this thick zone all the way to $118,000. None of these levels seem attainable anytime soon with the current price action, however.

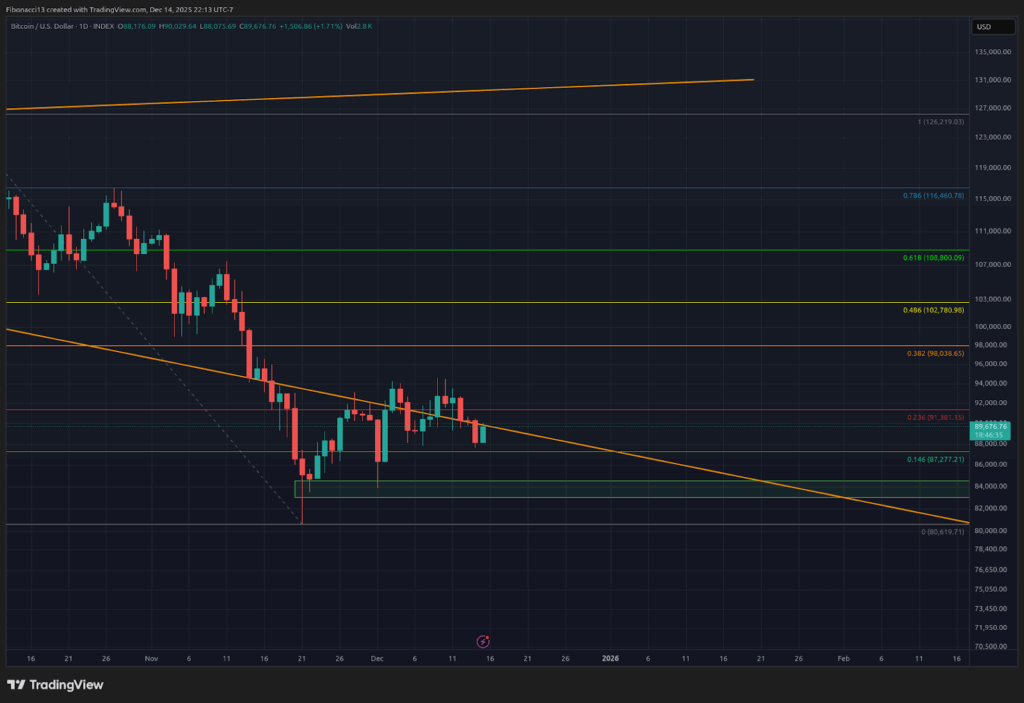

Outlook For This Week

Bitcoin’s weekly red candle close was not what the bulls wanted to see last week. The bears got a much-needed rest over the past few weeks and should see renewed strength this week. Look for the bears to attempt to break the $84,000 support level at some point this week, with bulls potentially trying to put in a bounce to maintain higher lows around the $87,000 to $85,000 area. If price drops below $84,000 this week, I would expect to see acceleration down to at least $75,000 and likely into the low $70,000 area.

Market mood: Extremely Bearish – Bulls had some time to try to push the price above short-term support over the last couple of weeks and failed to do so. The bears are in control and should be well rested for renewed selling strength to the downside.

The next few weeks

Sellers received a much-needed break over the past few weeks, while buyers were only able to pause the bearish momentum. Bears should take advantage here to take out the $84,000 support level. In the next few weeks, look for the support zone in the $72,000 to $68,000 area to be hit. However, we should see a strong bounce from this area after an initial test. So if this zone is touched, look for price to at least re-test the $84,000 level from down there, with potential for an even stronger bounce. This zone is a potential area for a reversal out of the bear market, but if the “4-Year Cycle” holds true, then the price would likely test lower later into 2026.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).