- Fidelity’s FBTC dominated inflows, with BlackRock’s IBIT also posting strong demand.

- Cumulative net inflows into US spot Bitcoin ETFs have exceeded $57 billion.

- Shifting US rate expectations are shaping institutional ETF positioning.

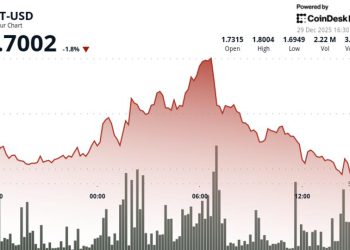

Spot Bitcoin exchange-traded funds listed in the US recorded a sharp revival in inflows on Wednesday, signalling renewed institutional engagement after weeks of uneven activity.

The move marked the strongest single-day intake in more than a month and coincided with shifting expectations around US monetary policy.

While Bitcoin’s price action remains constrained by heavy supply levels, ETF flows suggest investors are reassessing exposure through regulated products as macro conditions evolve.

Inflows rebound across major funds

US spot Bitcoin ETFs recorded $457 million in net inflows on Wednesday, their highest daily total since mid-November.

Fidelity’s Wise Origin Bitcoin Fund led the session, attracting roughly $391 million and accounting for the bulk of the inflows.

BlackRock’s iShares Bitcoin Trust followed with around $111 million, according to data from Farside Investors.

The latest intake pushed cumulative net inflows for US spot Bitcoin ETFs above $57 billion.

Total net assets climbed past $112 billion, equivalent to about 6.5% of Bitcoin’s total market capitalisation.

The figures underline the growing role ETFs play in shaping institutional access to Bitcoin exposure.

Shift after weeks of uneven flows

The inflow revival comes after a choppy period through November and early December, when ETF activity swung between modest inflows and sharp outflows.

That instability reflected cautious positioning amid uncertain price direction and tightening liquidity conditions.

The last time spot Bitcoin ETFs recorded inflows above $450 million was on November 11, when funds drew roughly $524 million in a single day.

The renewed activity suggests investors may be positioning earlier in anticipation of changing macro conditions, rather than responding to short-term price momentum.

ETF flows have increasingly become a barometer for how institutions interpret broader financial signals.

US rate signals influence positioning

Macro expectations shifted further on Wednesday after US President Donald Trump said he plans to appoint a new Federal Reserve chair who strongly supports cutting interest rates.

Speaking during a national address marking the first year of his second term, Trump said he would announce a successor to current Fed Chair Jerome Powell early next year.

He added that all known finalists favour lower rates than current levels.

Lower interest rates are generally viewed as supportive for risk assets such as crypto, as they ease financial conditions and improve liquidity.

Against this backdrop, spot Bitcoin ETFs appear to be attracting capital as a relatively direct way to express macro-driven positioning.

Price pressure and fragile demand persist

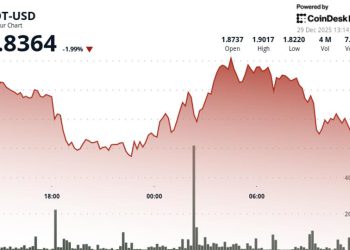

Despite stronger ETF inflows, Bitcoin’s market structure remains under pressure.

The asset has returned to price levels last seen nearly a year ago, leaving a dense supply zone between $93,000 and $120,000 that continues to cap recovery attempts.

This has pushed the amount of Bitcoin held at a loss to around 6.7 million BTC, the highest level of the current cycle, according to Glassnode.

Glassnode data also points to fragile demand across both spot and derivatives markets.

Spot buying has been selective and short-lived, corporate treasury flows episodic, and futures positioning continues to de-risk rather than rebuild conviction.

Until sellers are absorbed above $95,000 or fresh liquidity enters the market, Bitcoin is likely to remain range-bound, with structural support forming near $81,000.