It’s become fashionable of late to dismiss bitcoin’s four-year cycle — and the inevitable boom and bust it brings — as an anachronism.

Just in the past week, Bitwise’s Matt Hougan and ARK Invest’s Cathie Wood have thrown their considerable weight behind the idea of dismissing the four-year cycle. Each noted the ETFs along with regulatory and institutional acceptance that have blended bitcoin into the traditional financial system. Bitcoin is no longer a fringe asset and there’s no reason for it to follow the same pattern today as it did years ago.

Defining the cycle

The four-year cycle is a price pattern linked to bitcoin’s halving events, which occur roughly every four years. These halvings reduce by 50% the amount of bitcoin rewarded for mining one block. The 50% cut is thought to lead to a supply shock and forcing a major run higher in price.

Following the big bull move comes a crash in the 80% area and then a steady grind higher into the next halving event.

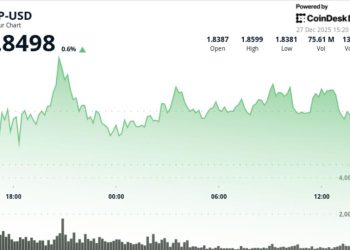

Chart squigglers like to point to the bull runs (and subsequent crashes) that occurred following the 2012, 2016, 2020 halvings, and say things are playing out the same for the 2024 event: the sharp run higher which eventually topped out in October 2025 above $125,000, and then the bear market — which is where the market finds itself now.

Fidelity’s Timmer weighs in

An early believer in bitcoin among the traditional finance crowd, Jurrien Timmer, asset management giant Fidelity’s director of global macro, isn’t seeing anything in his charts that says the four-year cycle is dead.

“If we visually line up all the bull markets, we can see that the October high of $125,000 after 145 [weeks] of rallying fits pretty well with what one might expect,” Timmer said earlier this week.

As for what’s next, that would be winter. Timmer noted that the subsequent bear markets tend to last about one year. “My sense is that 2026 could be a “year off” (or ‘off year’) for bitcoin.” Support, he concluded, is in the $65,000-$75,000 range.