Aave’s community members and participants have become sharply divided in recent weeks over control of the protocol’s brand and related assets, intensifying an ongoing dispute over the relationship between the decentralized autonomous organization (DAO) and Aave Labs, the centralized developer firm that builds much of Aave’s technology.

The debate has drawn outsized attention because it cuts to a central question facing many of crypto’s largest protocols: the tension between decentralized governance and the centralized teams that often drive execution. As protocols scale and brands accrue value, questions around who ultimately controls those assets, token holders or builders, are becoming harder to ignore.

The dispute was triggered by Aave’s integration of CoW Swap, a trade execution tool, which resulted in swap fees flowing to Aave Labs rather than the DAO treasury. While Labs argued the revenue reflected interface-level development work, critics said the arrangement exposed a deeper issue: who ultimately controls the Aave brand, which has over $33 billion in locked into its network. That question has now become central to the debate over ownership of Aave’s trademarks, domains, social accounts and other branded assets.

Supporters of DAO control argue the proposal would align governance rights with those who bear economic risk, limit unilateral control by a private company, and ensure the Aave brand reflects a protocol governed and funded by token holders rather than a single builder. Those who support the Lab having that position counter that taking brand control away from the builders could slow development, complicate partnerships and blur accountability for running and promoting the protocol.

The proposal has deeply divided community members, with opponents and supporters offering starkly different visions for the future of Aave.

Labs support

Supporters of Aave Labs argue that the company’s continued control over Aave’s brand and related assets is critical to the protocol’s ability to execute and compete at scale. They say Aave’s rise to prominence in DeFi is inseparable from Labs’ operational autonomy.

“Something that deserves more weight in these discussions is how much of Aave’s success over the years is due to Aave Labs/Avara, and how challenging it is to run an actual company as a DAO,” said Nader Dabit on X, a former Aave Labs employee. “DAOs are structurally incapable of shipping competitive software. Every product decision becomes a governance proposal, every pivot requires token holder consensus, and every fast-moving opportunity dies in a forum thread while competitors execute.”

From this perspective, Aave Labs’ stewardship of front-end assets has enabled faster iteration, clearer accountability and smoother engagement with partners — particularly those in traditional finance who require identifiable legal counterparties. Supporters warn that shifting brand control to a DAO-run legal entity could slow execution at a critical moment.

KPMG’s George Djuric has argued that forcing Aave Labs into a grant-dependent or tightly constrained operating model would risk turning builders into political actors rather than product teams. Such a structure, he said, would stifle innovation by turning proven developers into “politicians singing for their supper” every funding cycle.

Other supporters also push back on claims that brand control equates to economic extraction from the DAO. They note that protocol-level revenue remains fully under DAO control and that interface-level monetization — such as swap integrations — is intended to fund continued development that ultimately strengthens the protocol. In their view, Labs’ work expands the overall economic pie, increasing the DAO’s long-term earning potential rather than diminishing it.

A spokesperson for Aave Labs did not return a request for comment by press time.

DAO branded ownership

Supporters of the DAO taking control of branded assets argue the issue is not about blocking private companies from building products, but about aligning ownership with where execution and revenue generation now happen.

Marc Zeller, a longtime Aave contributor and founder at Aave-Chan Initiative, said in an X essay earlier Tuesday that the DAO has become the engine that maintains risk, ships upgrades and generates recurring revenue, while brand assets function as the storefront. DAO supporters do not dispute that Aave Labs continues to build and maintain much of the protocol’s tooling. Rather, they argue that ultimate control over upgrades, funding and risk has shifted to governance, with Labs operating as a core service provider alongside other contributors funded and overseen by the DAO. Problems arise when one private actor controls the storefront while the DAO ecosystem keeps the engine running.

Much of Aave’s growth over multiple market cycles has come from independent service outside teams that help run the system and keep it up to date — work that ultimately flows value back to the DAO. If branding and distribution remain under the control of a private entity, DAO supporters say token holders will lack leverage over how Aave is represented, monetized and steered over the long term.

The concern is structural rather than personal, however, Zeller said, If ownership of branding and distribution remains outside the DAO, token holders have limited leverage over how the protocol is represented, monetized or steered long term. The proposal argues that DAO ownership, with delegated management under enforceable terms, better reflects how Aave operates today.

“The Aave DAO vs. Aave Labs situation is probably the most important live debate around tokenholder rights today,” investment partner Louis Thomazeau wrote on X, underscoring the broader implications of the dispute for tokenholder governance models. “This isn’t just about Aave tokenholders; it matters to all tokenholders watching this unfold with growing concern.”

“Stani is out of touch if he thinks we’re “tired” of discussing tokenholders rights,” added Sam Rushkin, a Messari research analyst, on X.

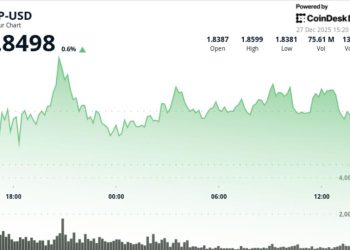

As of the latest results, roughly 58% of votes cast so far are against transferring ownership of Aave-linked assets to the DAO, with about a third of voters abstaining. The vote is scheduled to conclude on Friday.

Read more: Aave falls 18% over week as dispute pulls down token deeper than major crypto tokens