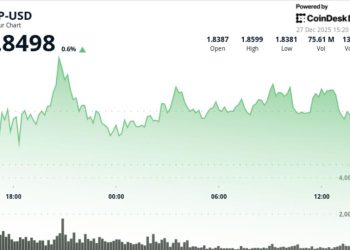

- Uniswap’s token UNI traded at $5.90 on December 26, 2025.

- Bulls are eyeing momentum as a key proposal passes

- A 100 million UNI token burn might buoy prices

The Uniswap community has approved a groundbreaking governance proposal known as “UNIfication,” marking a pivotal shift for the leading decentralized exchange (DEX).

This decision activates protocol fees and initiates a massive token burn.

Uniswap wants to potentially transform UNI from a simple governance tool into an asset that captures real economic value from the platform’s activity.

With trading volumes consistently high, this move could spark renewed interest and upward pressure on the token’s price.

Uniswap passes “UNIfication” proposal

The UNIfication proposal, put forward jointly by Uniswap Labs and the Uniswap Foundation, sailed through governance voting with near-unanimous backing.

Over 125 million UNI votes were cast in favor during the multi-day process, dwarfing the mere hundreds in opposition and easily surpassing the required quorum.

At its heart, the proposal flips on the long-dormant protocol fee switch. Uniswap, the top DEX in cryptocurrency, handles roughly $2 billion in daily trading volume, producing hundreds of millions in annualized fees based on data from platforms like DeFiLlama.

Previously, these fees went entirely to liquidity providers, leaving UNI holders with only governance rights and no direct tie to the exchange’s performance.

Now, a portion of fees will flow to an on-chain system specifically built to reduce token supply through burns. This creates a direct connection: higher platform usage leads to more tokens removed from circulation, which could support price appreciation over time.

In addition, the approval triggers a one-time retroactive burn of 100 million UNI tokens from the treasury.

Valued at approximately $590 million based on recent market prices, this action compensates for potential fees that might have accumulated since Uniswap’s launch in 2018 if the switch had been enabled earlier.

The changes will take effect following a short governance timelock period, solidifying Uniswap’s evolution toward greater sustainability and alignment between protocol growth and token holders.

UNI price signals reversal around $5.90

Following the proposal’s passage, UNI has shown signs of building momentum, trading around the $5.90 level as markets digest the deflationary implications.

Technical indicators point to a potential bullish reversal after a period of consolidation.

As the chart below shows, the Relative Strength Index (RSI) currently hovers above the neutral territory near 53. It’s upsloping and indicating neither overbought nor oversold conditions. This positioning leaves ample room for upward movement without immediate risk of exhaustion. It suggests buyers could step in aggressively on positive developments.

More encouraging is the Moving Average Convergence Divergence (MACD), where the histogram has turned positive in recent readings. This reflects growing bullish momentum, and a classic setup for trend reversals.

Analysts note that sustained momentum here could propel UNI toward short-term targets. In this context, the $6.50-$6.60 range could prove crucial for bulls if volume increases.

The combination of these indicators, alongside the fundamental catalyst from the fee activation and supply reduction, supports an optimistic price outlook. As protocol activity ties directly to token burns, UNI appears poised for renewed strength in the coming months.