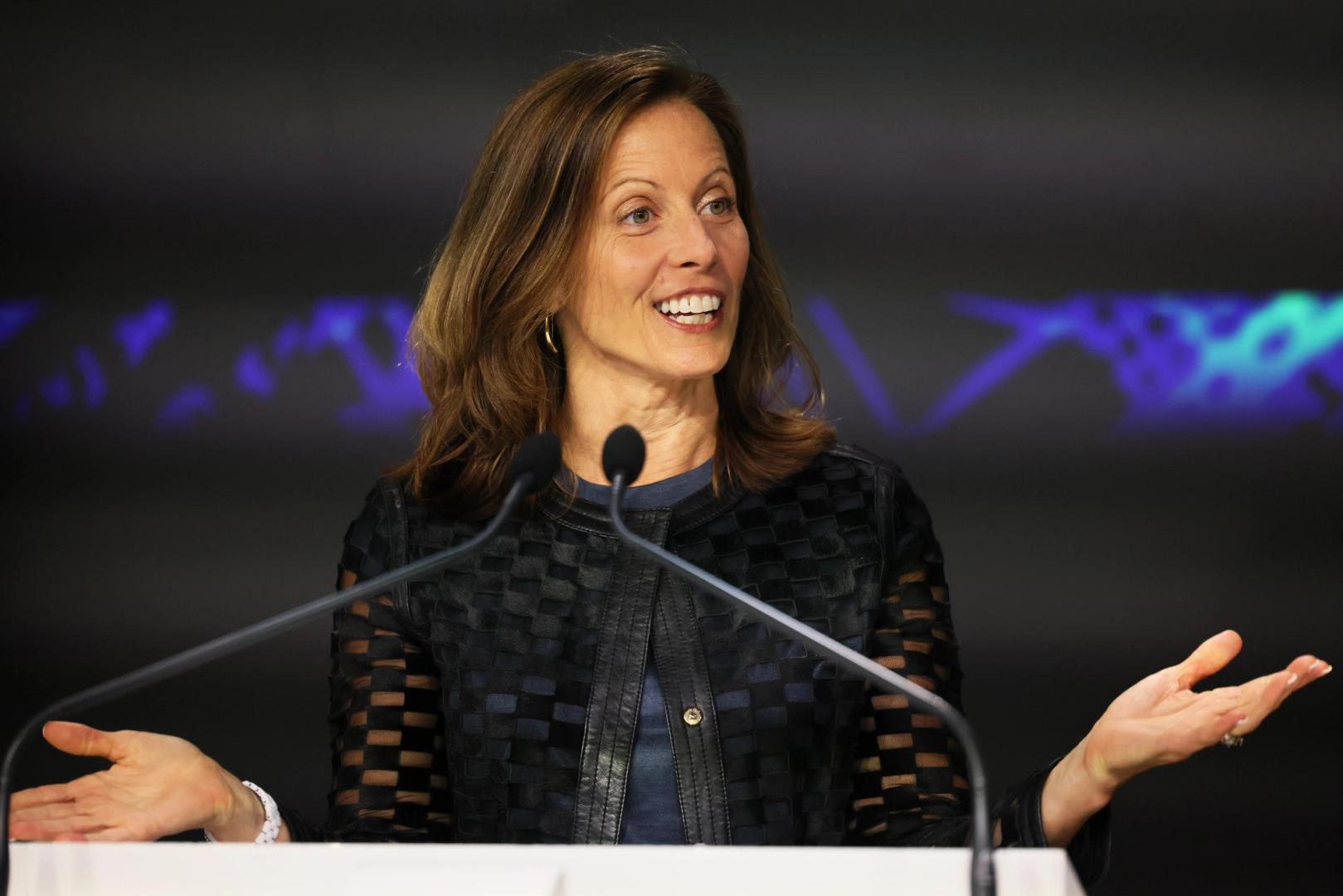

Nasdaq CEO Adena Friedman sees blockchain reshaping the traditional financial system in three key ways: by overhauling post-trade infrastructure, unlocking trapped capital through better collateral mobility and enabling faster, more seamless payments.

“There’s just so much capital trapped, whether it’s in clearinghouses or clearing brokers,” Friedman said during a discussion with Ripple President Monica Long at the Swell conference in New York on Tuesday. “If we do it right, we can actually make that an opportunity to deliver more capital to the system.”

Post-trade processes — the systems that finalize and settle securities transactions — remain deeply fragmented and often rely on decades-old infrastructure. Friedman noted that while some complexity is intentional, often for reasons like risk management or allocation tracking, much of the friction is unnecessary. She believes blockchain could help unify and streamline those workflows, cutting down on inefficiencies that tie up capital and slow down financial activity.

The second major opportunity lies in improving how financial institutions move and manage collateral — the assets pledged in trading and lending transactions to mitigate risk. According to Friedman, digital assets could make it easier to transfer collateral quickly across platforms and borders. “What we really love about the idea of digital assets is being able to move that collateral,” she said. “We can create a collateral mobility effort and … free a lot of capital.”

Payments are the third area ripe for change. While Nasdaq doesn’t operate in the payments sector, Friedman emphasized that smoother, more efficient payment systems are key to allowing investors to participate in global markets without friction.

She described today’s payment infrastructure as a bottleneck, slowing down the flow of capital. If those systems could be improved or rebuilt using blockchain, she said, it could unlock significant amounts of capital currently tied up in outdated processes. That, in turn, would help investors move funds more easily across platforms, borders and asset classes — making the financial system more open and efficient.

Nasdaq has already begun laying groundwork. The exchange operator recently filed with the U.S. Securities and Exchange Commission to support trading of tokenized securities. Under the proposed framework, an investor could flag a trade for tokenized settlement, and the post-trade system — including clearinghouse DTCC — would route it accordingly, allowing for delivery into a digital wallet. This approach, Friedman said, maintains the core structure of existing securities while offering investors greater flexibility.

She was quick to point out that the goal isn’t to replace or fragment U.S. equity markets, which she described as “extremely resilient” and “highly liquid,” but to enhance them by layering in technology that reduces friction and improves investor choice.

Tokenized markets may begin in post-trade functions, she said, but could eventually reshape how securities are issued and traded. “Let’s keep all those great things [about the U.S. markets], and then let’s put the technology in where we can actually reduce friction.”