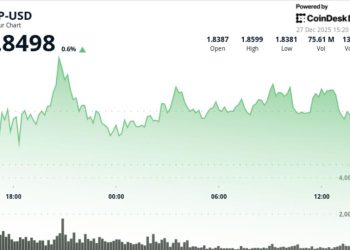

Wall Street giant Citi (C) said the sluggish start to the traditional Santa Claus rally may not yet derail the year-end equity rebound but points to bitcoin’s slump as a warning sign.

Bitcoin’s trading behavior has historically mirrored the Nasdaq 100’s fortunes: when the cryptocurrency sits above its 55-day moving average, returns on the Nasdaq improve markedly, analysts led by Dirk Willer wrote in the Thursday report.

With bitcoin now below that threshold, the analysts said the equity market’s risk-adjusted returns have weakened.

The bank’s analysts attributed the recent crypto weakness largely to tightening liquidity conditions. The U.S. Treasury’s rebuilding of its cash balance, combined with declining bank reserves, down roughly $500 billion since mid-July, has drained liquidity and pressured risk assets.

The analysts noted that while equities had been resilient thanks to the artificial intelligence (AI) boom, bitcoin tends to react faster to shifts in liquidity. The good news, the report said, is that Treasury balances are now near levels where rebuilding has typically stopped, suggesting liquidity could soon improve and revive both bitcoin and stocks.

Still, Citi sees new concerns emerging around the AI trade. Investors are questioning whether massive AI spending will yield sufficient returns, even as companies face surging hardware costs and supply constraints reminiscent of the late 1990s.

Hyperscalers such as Meta (META) and Alphabet (GOOGL) are also turning to debt markets to fund data-center buildouts, issuing tens of billions of dollars in new bonds. The bank noted that this shift toward credit financing echoes the dot-com era, though balance sheets remain far stronger today.

The report concluded that the debt issuance reflects opportunity rather than stress, but warned that the move from cash to credit is rarely a positive for bondholders.

Read more: Citi Says Crypto’s Weakness Stems From Slowing ETF Flows and Fading Risk Appetite