Bitcoin hovered near $92,000 on Tuesday as analysts and traders pointed to improving technical and macro signals suggesting the cryptocurrency may have put its brutal fourth-quarter sell-off behind it.

The price action comes after months of volatility that saw bitcoin fall as much as 35% from its October peak above $126,000, amid forced liquidations and selling pressure from long-term holders. While the asset ended December down for a third consecutive month — a historically rare pattern — several analysts argue the setup now favors a rebound.

“We believe with reasonable confidence that Bitcoin and broader digital asset markets have bottomed,” Bernstein analyst Gautam Chhugani and his team said in a note published Tuesday, identifying the late-November lows near $80,000 as the likely trough of the cycle.

Bernstein pushed back against concerns that bitcoin has already peaked within a traditional four-year cycle, calling such fears “overstated” in a market increasingly driven by institutional participation rather than retail speculation.

“As we have highlighted earlier, we believe the market concern on the four-year cycle pattern is unwarranted in the current market context, where institutional demand is driving adoption,” the analysts wrote.

Bitcoin to $200k by 2027?

Bernstein reiterated its long-term bullish outlook, maintaining price targets of $150,000 for bitcoin in 2026 and $200,000 in 2027. The firm argues that a broader “digital assets revolution,” including tokenization and regulated financial infrastructure, is extending the current bull market beyond historical norms.

Despite bitcoin’s roughly 6% decline in 2025, Chhugani noted that the year was broadly constructive for the crypto sector, particularly for crypto-related equities and initial public offerings.

Looking ahead, Bernstein expects a tokenization “supercycle” led by firms such as Robinhood, Coinbase, Figure, and Circle to continue drawing institutional capital into the space.

Other market observers echoed the view that downside momentum has eased. On Sunday, 10X Research said technical indicators now suggest bitcoin has entered a bullish trend, following weeks of range-bound trading through the holiday period.

“There is a good opportunity for a tactical rally,” said Sean Farrell, head of digital assets at Fundstrat, in comments on Monday. Farrell pointed to improving liquidity conditions, including expansion of the Federal Reserve’s balance sheet and a drawdown in the U.S. Treasury General Account, as supportive factors for risk assets such as bitcoin.

Fundstrat sees potential for bitcoin to test the $105,000 to $106,000 range under favorable conditions, though Farrell cautioned that his base case still includes the risk of a meaningful drawdown in the first half of the year before a stronger rally later in 2026.

Bitcoin technical analysis

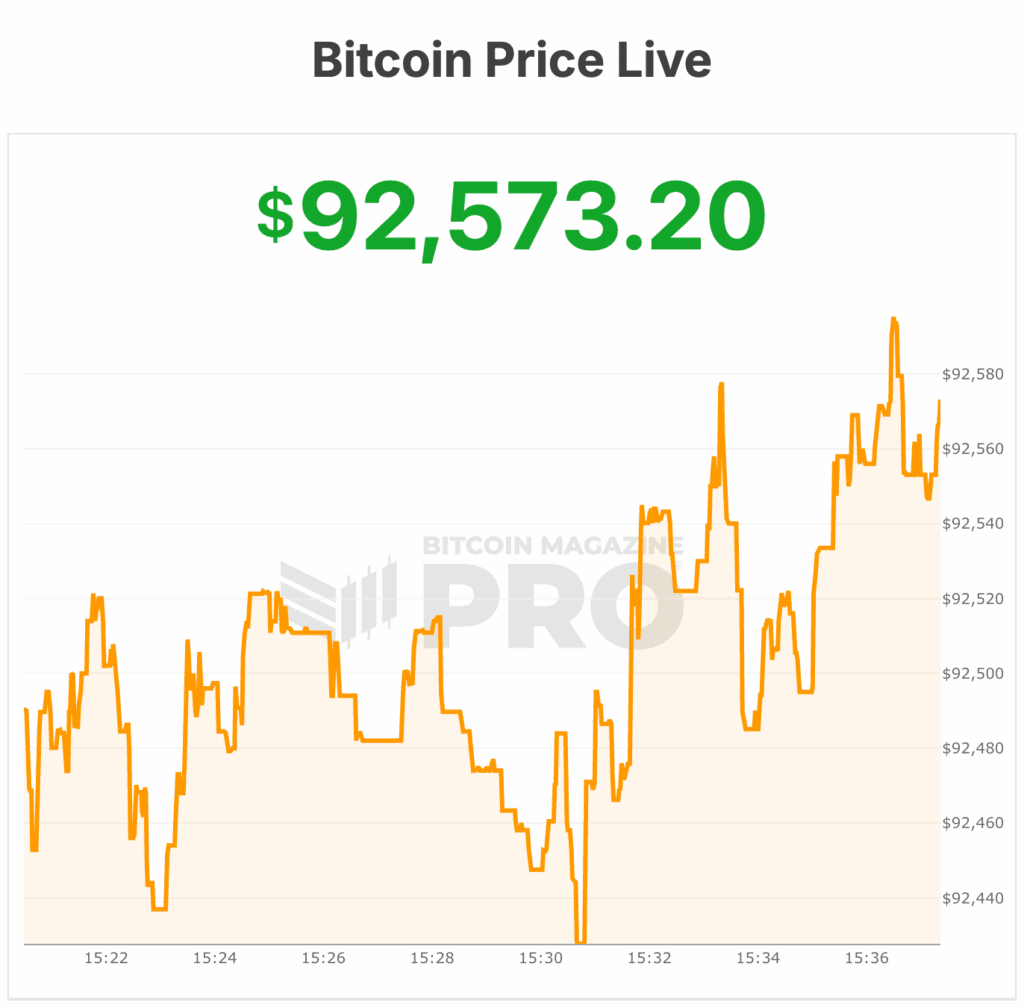

From a technical perspective, bitcoin closed last week near $91,500, just above short-term resistance around $91,400. Analysts say holding that level could open the door for another attempt at $94,000, a ceiling that has capped prices since mid-November. A sustained breakout could bring $98,000 into focus, with heavier resistance extending up toward the $103,500 to $109,000 zone.

On the downside, traders are watching support near $87,000, followed by a stronger band between $84,000 and $72,000 if selling pressure resumes. Market sentiment has shifted from outright bearishness to a more neutral stance as prices stabilize.

Bernstein also highlighted potential knock-on effects for bitcoin proxy equities, particularly Strategy. The analysts said a recovery in bitcoin’s price should help restore Strategy’s premium to net asset value, which has compressed significantly over the past year.

“As concerns over MSTR’s liquidation event get resolved, we expect a strong recovery in MSTR premium to NAV towards its historical average,” the analysts wrote. Strategy has historically traded at an average multiple-to-net asset value of 1.57, compared with roughly 1.02 this week.

Strategy has continued to finance bitcoin purchases through a mix of equity issuance and preferred stock offerings, while recently building a $2.25 billion “USD Reserve” to pre-pay dividend obligations.

Still, the company faces risks, including potential exclusion from MSCI indices, which could trigger index-related outflows.