- Long-term holders have sold approximately 400,000 Bitcoin ($45B) in the past month.

- This sell-off is driven by spot markets and fading conviction, not high leverage.

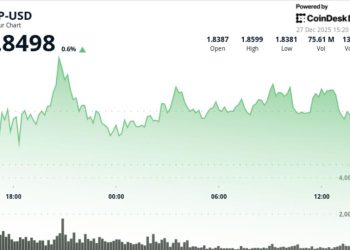

- Bitcoin fell below the key $100,000 level for the first time since June.

Bitcoin has once again slipped below the critical $100,000 mark, but the force driving this latest downturn is different and potentially more concerning for the market.

Unlike the leverage-fueled crash in October, this sell-off is being driven by a quieter, more sustained exodus: long-term holders are cashing out, creating a $45 billion supply glut that is testing the market’s conviction.

The original cryptocurrency fell as much as 7.4% on Tuesday, marking a more than 20% decline from its record high a month ago.

While it has since staged a modest recovery, the nature of the selling pressure suggests a fundamental shift in market dynamics.

From forced liquidations to fading conviction

The key difference in this downturn is the source of the selling.

While October’s crash was defined by a cascade of forced liquidations from overleveraged traders, the current slide is being led by a steady drumbeat of selling in the spot market.

According to Markus Thielen, head of 10x Research, long-time Bitcoin holders have offloaded approximately 400,000 Bitcoin over the past month—an exodus valued at around $45 billion.

This sustained selling from seasoned investors is creating a market imbalance that new buyers are struggling to absorb.

This analysis is supported by on-chain data.

“Over 319,000 Bitcoin has been reactivated in the past month, mainly from coins held for six to twelve months — suggesting significant profit-taking since mid-July,” Vetle Lunde, head of research at K33, told Bloomberg.

The whale problem: big buyers are disappearing

With market leverage now relatively muted, attention has turned to the large, long-time holders who are choosing to sell.

Thielen told Bloomberg that “mega whales”—entities holding between 1,000 and 10,000 Bitcoin—began offloading large volumes earlier this year.

For a time, institutional players were able to absorb this supply, leading to choppy, sideways price action.

However, since the October crash, broader demand has faded, and the accumulation by smaller whales (holding 100 to 1,000 Bitcoin) has dropped sharply.

The result is a growing imbalance between sellers and buyers. “The whales are just not buying,” Thielen said.

What comes next? A path to further declines

This sustained selling from long-term holders could have lasting implications.

Thielen warns that the current unwind could continue well into next spring, drawing parallels to the 2021–2022 bear market, where large holders sold over one million Bitcoin over the course of nearly a year.

“If this is a similar pace,” he said, “we could see this situation going on for another six months.”

While not predicting a catastrophic crash, Thielen sees room for further declines as the market consolidates.

“I am not a believer in the cycle,” Thielen said, “but I would assume that we sort of consolidate and potentially drift even a bit lower from here. $85,000 is my maximum downside target.”