Strategy (formerly MicroStrategy) is currently navigating the most complex regime in its four-year history as a corporate Bitcoin treasury.

The company, which transformed itself from a steady enterprise software provider into the world’s largest corporate holder of BTC, is facing a convergence of headwinds that threaten the structural mechanics of its valuation.

For years, the Tysons Corner-based firm operated with a distinct advantage that allowed its equity to trade at a significant premium to the net asset value (NAV) of its Bitcoin holdings.

This premium was not merely a sentiment indicator as it was the engine of the company’s capital strategy. It allowed management to raise billions in equity and convertible debt to acquire Bitcoin, effectively engaging in regulatory arbitrage that benefited from the lack of spot Bitcoin ETFs in the US market.

However, with Bitcoin recently sliding into the low $80,000s and MicroStrategy shares compressing toward $170, that valuation cushion has evaporated.

The stock is now hovering near parity with its underlying assets (a unity NAV scenario), which fundamentally alters the firm’s economics.

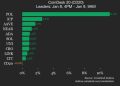

MSTR leverage breakdown

The collapse of the premium mechanically disables the company’s primary method of value creation.

Since adopting the Bitcoin standard, MicroStrategy relied on what supporters framed as intelligent leverage and what critics described as an infinite issuance loop.

The mechanics were straightforward: as long as the market valued $1 of MicroStrategy equity at $1.50 or $2, the company could issue new shares to purchase underlying assets, mathematically increasing the Bitcoin per share for existing holders.

This accretive dilution was the cornerstone of Executive Chairman Michael Saylor’s pitch to institutional investors. It effectively turned share issuance (usually a negative signal for equity holders) into a bullish catalyst.

The company even formalized this metric, introducing BTC Yield as a key performance indicator to track the accretiveness of its capital markets activity.

In a parity environment, however, this arithmetic breaks down. If MicroStrategy trades at 1.0x NAV, issuing equity to buy Bitcoin becomes a wash trade that incurs transaction costs and slippage.

There is no structural uplift. So, if the stock slips into a discount, trading below the value of its Bitcoin stack, issuance becomes actively destructive to shareholder value.

The debt side of the equation is also becoming more expensive.

Strategy faces increasing costs to maintain its massive 649,870 BTC stash, with its annual obligations now nearing $700 million.

However, the firm insists that it still has 71 years of dividend coverage assuming BTC’s price stays flat. It also added that any BTC appreciation beyond 1.41% a year would fully offset its annual dividend obligations.

The passive flow cliff

While the vanishing premium arrests the company’s growth engine, a looming decision by MSCI Inc. presents a more immediate structural threat.

The index provider is conducting a consultation on the classification of Digital Asset Treasury (DAT) companies, with a decision expected after the review period ending Dec. 31.

The core issue is taxonomy. MSCI, along with other major index providers, maintains strict criteria separating operating companies from investment vehicles.

If MicroStrategy is reclassified as a DAT, it risks expulsion from flagship equity benchmarks, potentially triggering forced selling of between $2.8 billion and $8.8 billion by passive funds.

However, MicroStrategy management has issued a forceful rebuttal to this categorization, arguing that the passive label is a fundamental category error.

In a statement to stakeholders, Saylor rejected comparisons to funds or trusts, emphasizing the firm’s active financial operations.

According to him:

“Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.”

Meanwhile, his defense hinges on the company’s pivot toward structured finance.

Saylor points to the firm’s aggressive issuance of digital credit securities, specifically the STRK through STRE series, as proof of active management rather than passive holding.

According to company data, these five public offerings accounted for over $7.7 billion in notional value this year. The company also launched Stretch (STRC), a Bitcoin-backed treasury credit instrument offering a variable monthly USD yield.

He noted:

“Funds and trusts passively hold assets. Holding companies sit on investments. We create, structure, issue, and operate. Our team is building a new kind of enterprise—a Bitcoin-backed structured finance company with the ability to innovate in both capital markets and software. No passive vehicle or holding company could do what we’re doing.”

As a result, the market is now weighing this Structured Finance narrative against Bitcoin’s overwhelming presence on the balance sheet.

While the software business exists, and the STRC instrument reflects genuine financial innovation, the company’s correlation to Bitcoin remains the primary determinant of its stock performance.

So, whether MSCI accepts the definition of a digital monetary institution will determine if MicroStrategy avoids the flow cliff in early 2026.

Will MSTR survive?

The question is not whether MicroStrategy will survive, but how it will be valued.

If Bitcoin reclaims momentum and the premium respawns, the company may return to its familiar playbook.

However, if the equity remains tethered to NAV and MSCI proceeds with reclassification, MicroStrategy enters a new phase. This would effectively transition the firm from an issuance-driven compounder into a closed-end vehicle tracking its underlying assets, subject to tighter constraints and reduced structural leverage.

For now, the market is pricing in a fundamental shift. The “infinite loop” of premium issuance has stalled, leaving the company exposed to the raw mechanics of market structure.

So, the coming months would be defined by the MSCI decision and the persistence of the parity regime, which would determine if the model is merely paused, or permanently broken.

The post Can MicroStrategy survive reclassification as a Bitcoin investment vehicle? appeared first on CryptoSlate.