- LINK jumps 3.6% to $16.96 amid strong institutional buying near key support.

- Stellar joins Chainlink Scale, integrating CCIP, Data Feeds, and Data Streams.

- Stellar reports $5.4B RWA volume and 700% growth in smart contract activity in Q3 2025.

Chainlink’s native token LINK bounced back 3.6% on Friday, climbing to $16.96 as institutional buyers stepped in near key support levels.

The rebound follows strong trading volume with over 3 million tokens exchanged during the morning breakout.

More importantly, payments-focused blockchain Stellar announced a major integration with Chainlink’s suite of services, including the Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams.

This collaboration signals growing institutional demand for secure financial infrastructure and positions both networks to capitalize on the expanding real-world asset tokenization market, which analysts project could reach $2 trillion by 2028.

Stellar’s strategic play into RWA and DeFi

Stellar’s decision to join the Chainlink Scale program marks a significant strategic move for the payments-focused blockchain.

The integration gives developers and institutions on Stellar access to battle-tested infrastructure that currently secures over $100 billion in total value locked across DeFi protocols.

The timing couldn’t be better. Stellar reported impressive growth metrics in Q3 2025, logging $5.4 billion in real-world asset transaction volume.

The network also experienced a 700% quarterly surge in smart contract invocations and welcomed a 37% increase in full-time developers.

These metrics reflect a growing ecosystem hungry for institutional-grade tools to bridge traditional finance with blockchain infrastructure.

With Chainlink’s CCIP integration, Stellar developers can now move assets across blockchains without rewriting smart contracts. This streamlines complex operations like cross-chain lending and yield farming into single, atomic processes.

Data Feeds and Data Streams complement this by providing real-time, trusted pricing information—critical for DeFi protocols handling significant capital flows.

Standard Chartered’s Geoffrey Kendrick recently projected a $2 trillion DeFi tokenization boom by 2028, driven by surging demand for tokenized equities, funds, and stablecoin-based money-market products.

Stellar’s adoption of Chainlink positions it squarely to capture a share of this trend, especially as Wall Street institutions increasingly explore tokenized assets.

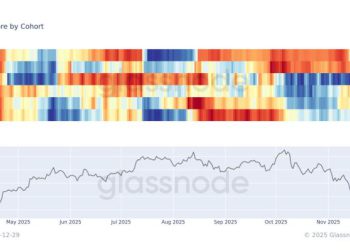

What this means for LINK’s technical picture

The 3.6% rebound placed LINK above critical technical levels, though weakness during U.S. trading hours pulled the token back below the $17 mark.

Traders now watch support at $16.37, with near-term upside targets at $17.46 and $18.00.

Technical analysts suggest LINK is emerging from an oversold setup.

The Relative Strength Index recently hovered at levels indicating fading bearish momentum, while Bollinger Bands positioned LINK near the lower band, a signal of potential reversal.

The 78% volume surge during the breakout confirmed institutional participation, though short-term rebalancing created some profit-taking.

For the broader picture, crypto analysts expect LINK to trade between $16.77 and $18.79 in November 2025, with potential upside toward $20–$25 if buyers sustain momentum above key resistance levels.

The Stellar integration demonstrates that enterprise adoption of Chainlink’s technology remains robust despite recent price weakness.

Whether LINK extends its rebound depends largely on broader crypto market sentiment and sustained institutional buying interest around current support zones.