Circle Internet’s (CRCL) dollar-pegged stablecoin, USDC, grew faster than larger rival Tether’s USDT for the second straight year in 2025, fueled by rising demand for regulated, blockchain-based dollars as the U.S. government warmed to digital assets.

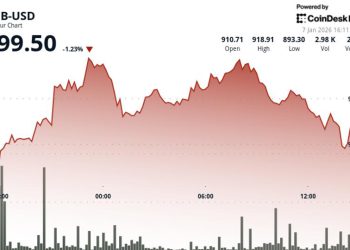

USDC’s market capitalization increased 73% to $75.12 billion while USDT added 36% to $186.6 billion, according to CoinDesk data. In 2024, USDC grew by 77% compared with USDT’s 50%.

Circle Internet, based in New York, was founded in 2013 by Jeremy Allaire and Sean Neville and went public on New York Stock Exchange (NYSE) in last June. USDC is backed by cash and short-term U.S. Treasuries held at regulated institutions.

In the U.S., Circle holds money transmission licenses in various states and territories, as well as a virtual currency license in the State of New York. In Europe, it complies with the MiCA framework post-2024 and operates under e-money licenses in key jurisdictions.

Tether’s USDT remains unregulated in the U.S. and Europe. The company, founded in 2014 and led by CEO Paolo Ardoino, operates as a licensed digital asset service provider in El Salvador. Tether did not respond to an emailed request for comment.

Trust factor

USDC’s outperformance seems to be rooted in institutional demand for assets that meet regulatory guidelines, observers noted.

The GENUIS Act created a comprehensive framework for payment stablecoins and digital tokens pegged to monetary value and intended for payments. That prompted several high-profile investment banks and institutions to explore stablecoins, particularly regulated ones such as the USDC.

The token, for example, has been actively integrated and preferred by companies including Visa, Mastercard and BlackRock, primarily for settlement and treasury operations.

“USDC’s transparent reserve management and regular audits make it more trustworthy among institutional investors and other regulated entities,” analysts at JPMorgan said in a note in October.

“Additionally, its compliance with frameworks like the Markets in Crypto-Assets (MiCA) regulation in Europe sets it apart from competitors, making USDC the preferred stablecoin for financial institutions,” they added.

USDC and USDT together account for over 80% of the total stablecoin market value of $312 billion, a sign that other tokens have yet to catch benefit from regulatory developments in the world’s largest economy.

“Treasury Secretary Scott Bessent has repeatedly stated that the stablecoin market could grow to USD 3.7T by the end of the decade. In this context, it remains to be seen whether stablecoin growth will remain confined to USDt and USDC, or will expand meaningfully to other tokens,” analyst at FRNT Financial said in a Friday newsletter.

“Nevertheless, crypto proponents are optimistic that stablecoin proliferation will bring new capital and users into the crypto ecosystem in 2026,” they added.