- Mike Selig is positioned to replace Acting Chair Caroline Pham at the CFTC if confirmed.

- The CFTC has already expanded crypto oversight through collateral approvals and spot trading permissions.

- Travis Hill’s confirmation would formalise his interim role at the FDIC and continue crypto-friendly banking policies.

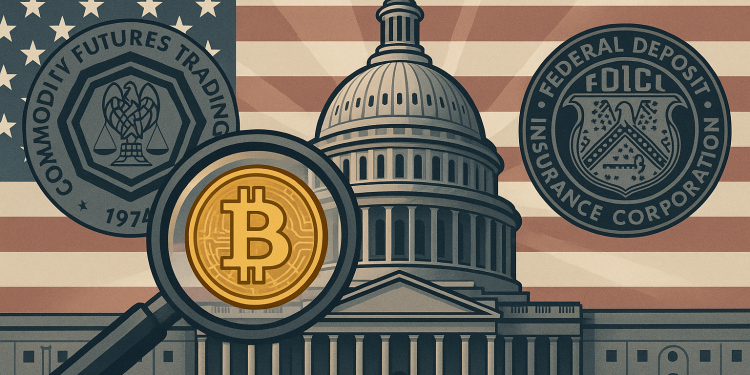

Crypto regulation in the United States is entering a more defined phase as Senate procedures bring key financial watchdog appointments closer to completion.

Two agencies with direct influence over digital assets, the Commodity Futures Trading Commission and the Federal Deposit Insurance Corp., are on the verge of formal leadership changes, as per a CoinDesk report.

President Donald Trump’s nominees to chair both regulators have advanced through the Senate confirmation process, signalling a potential shift in how crypto markets and crypto-linked banking are supervised.

While the final votes have not yet taken place, recent developments suggest that decisions are approaching, narrowing uncertainty around regulatory direction.

Senate clears path for final votes

The Senate moved the process forward on Thursday by approving a resolution that clears the way for final confirmation votes.

The measure passed by a 52–47 margin and applies to a large group of nominees being considered together, reports CoinDesk.

Mike Selig, nominated to lead the CFTC, and Travis Hill, nominated to become chairman of the FDIC, are among the names included.

A spokeswoman for Senate Majority Whip John Barrasso said on X that the final vote is likely early next week, though the chamber remains days away from formally confirming the candidates.

Republicans in the Senate have adopted a strategy of voting on dozens of nominations in batches rather than individually. In this round, lawmakers are deciding on 97 confirmation questions at the same time.

Selig and Hill represent only two of those positions, but both roles carry outsized importance for the crypto sector.

The approach has helped accelerate confirmations but has also compressed scrutiny of individual nominees.

CFTC positions itself as crypto regulator

Selig currently serves as a senior official at the Securities and Exchange Commission, where he has been working on crypto-related issues.

If confirmed, he would replace Acting Chair Caroline Pham, who has guided the CFTC through a series of initiatives seen as supportive of digital asset markets.

Under Pham’s leadership, the CFTC has positioned itself as an active player in crypto supervision, even as Congress continues to debate broader market structure legislation.

The agency is widely expected to take a leading role in crypto oversight if lawmakers eventually pass a bill that formally assigns authority.

Even without new legislation, the CFTC has already expanded its reach.

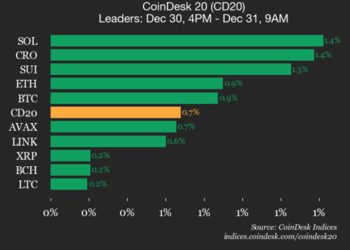

It has created a CEO council to advise on policy matters, approved the use of Bitcoin BTC $92,157.53, Ether ETH $3,237.28, and USDC, along with other payment stablecoins as collateral, and allowed registered firms to offer spot crypto trading services.

These steps have embedded crypto more deeply into regulated financial activity.

FDIC banking stance comes into focus

At the FDIC, Hill has already been serving as interim chief, meaning his confirmation would formalise an existing role rather than introduce new leadership, notes CoinDesk.

During his interim tenure, Hill has pursued policies that indicate a more accommodating stance toward crypto banking.

This includes engagement with banks that provide services to digital asset firms, an area that has previously faced uncertainty due to regulatory caution.

Oversight framework begins to align

Together, the pending confirmations point toward a more coordinated regulatory environment for crypto in the US.

With leadership at both the CFTC and FDIC close to being finalised, oversight of crypto markets and crypto-related banking may soon operate under clearer and more consistent supervision.