- Decred price dips 17% after a strong weekly rally and high profit-taking.

- The key support at $32.54 is critical to maintain the bullish momentum.

- Analysts highlight long-term targets up to $224.52 for Decred (DCR).

Decred price has faced a short-term setback as the DCR token fell 17.24% to $33.26, contrasting sharply with its impressive weekly surge of over 60%.

While some investors are taking a cautious approach after an extended rally, many remain optimistic about Decred’s long-term prospects, especially considering its unique hybrid governance model and privacy-oriented features.

DCR dips amid profit-taking and regulatory uncertainty

Decred (DCR) experienced a notable decline today following an intense period of profit-taking.

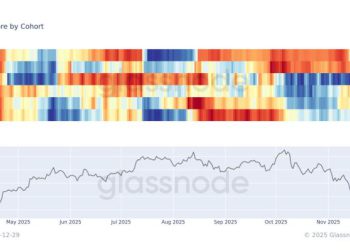

Over the past month, DCR has surged by more than 140%, and the heightened activity is evident in its 24-hour trading volume, which jumped over 100% to $92.9 million.

Traders appear to be locking in gains after a parabolic rise, which coincides with a cooling off from previously overbought conditions.

Notably, the 7-day RSI, now at 60.26, reflects a natural pullback, highlighting the market’s temporary hesitance to push the price higher immediately.

Regulatory concerns are also adding a layer of uncertainty.

Discussions around the EU’s proposed 2027 ban on anonymous crypto transactions have resurfaced, creating hesitancy among investors.

While Decred’s hybrid governance model and resilient fundamentals offer some protection, the regulatory environment for privacy-focused coins remains a key risk factor.

Cryptocurrency exchanges, such as Upbit, are historically wary of compliance issues and have delisted DCR in the past, amplifying short-term caution among traders.

Technical signals show cooling, but long-term potential

From a technical perspective, the DCR price recently broke below its pivot point of $33.95 and the Fibonacci 23.6% retracement at $35.1, suggesting a short-term bearish trend.

The MACD histogram has narrowed to +1.41, signalling a potential slowdown in upward momentum.

According to some market analysts, maintaining above $32.54 is critical for DCR to preserve its breakout momentum from the past week, allowing the token to potentially resume its upward trajectory.

If DCR can hold the $30–$32 support zone, it may stabilise and prepare for another upward push.

Failing to maintain this support could expose the altcoin to further declines toward $29.51, though the 30-day SMA at $20.88 continues to indicate that the long-term structure remains intact.

Conversely, should Decred (DCR) price climb past $35.42, it could target the next resistance at $38.93, with a longer-term goal of $56.86.

Decred price forecast amid the market pullback

Investor sentiment toward DCR remains cautiously optimistic despite the recent pullback.

Rekt Capital, for instance, recently highlighted that Decred has followed a setup shared over a year ago, rallying 140% across the range before breaking out for an overall 500% gain.

Decred has followed through on a setup shared in the Hall of Fame Pro over a year ago

Rallied +140% across the Range & broke out from it for a +500% rally overall

Decred took time but maybe the upside was worth the waithttps://t.co/CWLXYsY4t2#DCR #decred #BTC pic.twitter.com/OPspzwbqRO

— Rekt Capital (@rektcapital) November 9, 2025

This historical perspective underscores the altcoin’s potential for long-term upside.

Adding to this optimism, crypto analyst Javon pointed out that DCR’s target of $224.52 remains unchanged, noting that the early-stage climb toward this price could just be beginning.

Javon’s assessment emphasises that while short-term corrections are natural, the broader trend for Decred remains bullish, supported by both technical fundamentals and investor confidence in its hybrid governance and privacy features.

$DCR‘s target at the $224.524761 goes unchanged as prices continue to hold well broken out of an older resisting trend and a more than 470X climb to reach it can be in its early stages here.

That’s a near 6X!

(Decred) https://t.co/MZ7q9yzO1L pic.twitter.com/8wDIkS30gI

— JAVON⚡️MARKS (@JavonTM1) November 9, 2025

In essence, while the Decred price has faced a necessary cooling-off phase amid profit-taking and regulatory uncertainties, key support levels and historical performance suggest that the altcoin may soon regain upward momentum.

With the DCR token holding strong near crucial supports and bullish indicators from market experts like Rekt Capital and Javon, investors may find opportunities to enter or expand positions while monitoring short-term fluctuations.