- SEC clears FUSE token as a non-security, providing regulatory clarity.

- FUSE token rewards network participation and green energy actions, not profits.

- Market shows renewed momentum, boosting FUSE token price outlook.

The US Securities and Exchange Commission (SEC) issued a no-action letter to Fuse, a Solana-based decentralised physical infrastructure network (DePIN) project, providing the token with rare regulatory clarity.

This development has sparked optimism on the FUSE token’s potential, highlighting its utility-driven design and positioning it as a notable example of how blockchain projects can navigate US securities regulations.

SEC clears Fuse

Fuse Crypto submitted a formal request to the SEC’s Division of Corporation Finance on November 19, seeking confirmation that it could continue offering its FUSE token without triggering enforcement action.

In its response, the SEC confirmed it would not recommend enforcement, based on the specific facts and circumstances described by Fuse.

This no-action letter, while conditional, marks a significant milestone for the project, as such regulatory guidance is rare in the crypto space.

Notably, the SEC decision signals a shift under Paul Atkins’ leadership toward a more practical and balanced approach to token oversight, contrasting with the more stringent policies of previous administrations.

Unlike speculative tokens, the FUSE token is designed for participation and network utility.

It functions as a reward for users maintaining Fuse’s distributed infrastructure rather than as an investment vehicle.

Holders earn tokens through active engagement, such as contributing to the network’s Solana-based operations, installing solar panels, or using electric vehicle chargers.

By linking token rewards to tangible, energy-focused activities, Fuse has structured FUSE as a consumptive asset that aligns with regulatory expectations, reducing the risk of it being classified as a security under US law.

Utility-driven token model

The SEC highlighted that FUSE token holders do not expect profits from Fuse’s managerial efforts, and the token does not grant ownership, dividends, or voting rights.

This utility-driven framework allows participants to redeem tokens for benefits such as energy bill discounts, priority access to home electrification upgrades, or carbon-offset programs.

By emphasising real-world use cases and sustainable energy participation, Fuse has created a model where blockchain technology directly incentivises environmentally conscious behaviour.

The token’s scalability ensures it can grow alongside the project’s broader green energy initiatives, reinforcing its role as a functional, consumptive asset rather than a speculative instrument.

The approval has resonated across the DePIN sector, a space valued at over $24 billion, as it provides a blueprint for other infrastructure-driven blockchain projects.

Fuse’s approach demonstrates how decentralised networks can effectively integrate tokenised rewards with practical utility, offering both financial and environmental value to participants.

Market impact and FUSE token price outlook

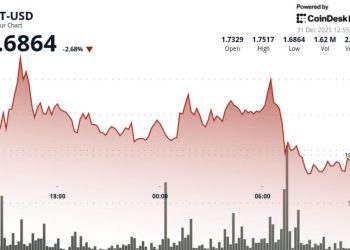

Following the announcement, the FUSE token has shown signs of regaining momentum in trading markets.

Current figures indicate that the token trades around $0.0077, with a market capitalisation of approximately $2.4 million and total value locked exceeding $68 million.

Over the past year, the token experienced a significant decline from its all-time high of $2.13 in January 2022, but the SEC’s no-action letter has injected renewed confidence among investors.

Looking ahead, Fuse’s strengthened regulatory position, combined with its utility-oriented model, could positively influence the FUSE token price outlook over the medium term.