In brief

- Some Strategy observers note the failure of other large companies in the past.

- The company’s stock price has dropped 30% over the past month as BTC’s price has fallen.

- MSTR has acknowledged the possibility of selling some of its 650,000 Bitcoin.

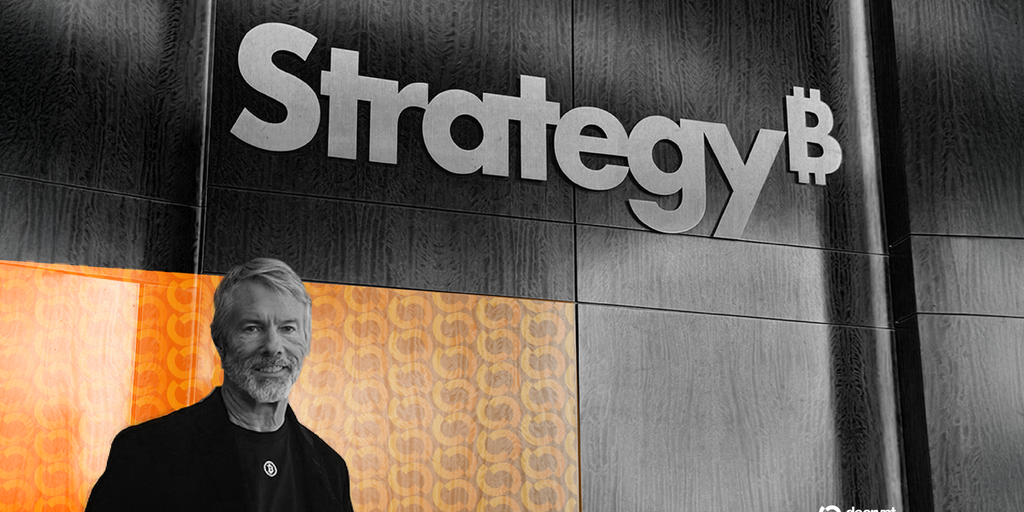

Fears that Bitcoin treasury Strategy could collapse have spiked after a spate of bearish news, including potential removal from stock indices and Michael Saylor acknowledging that the firm might have to sell Bitcoin for the first time.

Three observers of the company, which holds 650,000 Bitcoin worth about $60 billion and accounts for 3.1% of the total supply, said that the company is not too big to fail as some larger companies have in the past.

“Public companies can and do completely implode,” Eli Cohen, corporate lawyer and general counsel for on-chain asset infrastructure firm Centrifuge, told Decrypt. “Enron and Lehman Brothers are the most famous examples. More recently, the banks Silicon Valley Bank, Silvergate, and Signature were all public companies that went bankrupt, and the equity holders were zero’d out.”

Strategy’s stock (MSTR) has dropped 30% to $185.88 over the past month, partly thanks to the 13% decline of Bitcoin over the same period. MSTR has dropped 65% from its all-time high set in November 2024, while Bitcoin has slipped 6% over this period, per CoinGecko.

Energy company Enron was the seventh-largest U.S. company before its catastrophic collapse in 2001—in which the stock dived from $90 to just $0.26. Its executives had been inflating revenues and hiding debt through fraudulent accounting practices. (The company was later bought by new actors who introduced a meme coin, which is now part of a fraud and racketeering class action lawsuit.)

The concept of “too big to fail” comes from the 2008 global financial crisis, in which a number of major financial services companies collapsed, shocking analysts who considered these companies immune from such calamity. Analysts tracking the digital asset space once held a similar view about exchange giant FTX and other failed crypto-focused companies, including crypto hedge fund Three Arrows Capital.

But some Strategy observers, mostly found across social media, argue that the Bitcoin treasury firm cannot collapse. They believe that because Strategy is publicly traded, events similar to those that felled other crypto companies will not occur.

They note that Strategy, formerly called MicroStrategy, is the world’s 433rd largest company by market cap, according to CompaniesMarketCap, and that someone would bail out the firm rather than risk the consequences of a disastrous collapse.

Others, such as Mitchell “Nom” Rudy, board member of BONK treasury company Bonk, Inc., argue that failure is at least unlikely.

“It likely has enough inertia to survive despite being a clear target of fud/attacks by various institutions and policies,” Rudy told Decrypt. “In the case of its mNAV compression below 0 to the point where it needs to begin selling BTC, you could either have opportunists be ready to deposit more BTC as part of deals, or take advantage of the stock during times of weakness.”

Katherine Dowling, general counsel and COO at Bitwise Asset Management noted the company’s strong fundamentals, and that there will be inevitable ups and downs with its hefty Bitcoin bet.

But Cohen and Trantor, the pseudonymous head of Linea-based decentralized exchange Etherex, told Decrypt that no entity would rescue Strategy similar to the bailout packages that helped a number of teetering institutions in 2008 remain solvent.

“[Strategy] doesn’t have the same vital connections to the financial system as large banks, despite what some people may believe,” Trantor said.

“No one will bail them out,” Cohen added. “If MSTR goes bust, the equity holders will lose most or all of their investments. Moreover, any recovery will take years.”

Sal Ternullo, who co-led the cryptoasset services for KPMG when it audited MicroStrategy in 2020, told Decrypt that ”the real danger” to the company is a “liquidity crunch.”

“If a company lacks the cash reserves—whether from operations or ATM facilities—to buy back its own stock when it trades at a discount,” he said, “if that discount persists and the company is cash-poor, shareholders will eventually pressure management to sell off the balance sheet assets to fund buybacks.”

Strategy has acknowledged this looming threat, with Saylor publicly stating that the firm could sell Bitcoin if its market-adjusted net asset value, or mNAV, dropped below 1—it is currently 1.14, according to Strategy’s site. That is despite Saylor repeatedly advising investors to never “never sell” their Bitcoin. To prevent such an outcome, Strategy recently created a $1.44 billion cash reserve to pay dividends if needed and prevent that possibility.

Bitwise’s Dowling believes that selling Bitcoin would be a “good addition” to its strategy, but Saylor’s public stance against selling Bitcoin has complicated that task. For that reason, Strategy publicly selling could cause fear to spread market-wide, she said, as the company owns approximately 3.1% of the total Bitcoin supply.

“Any decision to sell BTC by the Strategy would likely lead to very negative responses from the market and may indeed see market participants seek to ‘front run’ the news by increased selling and short activity,” Trantor said. “While it is unlikely that this would lead to a total price collapse, the wider crypto market is on the hunt for the next ‘Terra Luna or FTX’ style collapse, and this would feed into that bearish confirmation bias.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.