In brief

- Bitcoin mining firms face structural risks beyond halvings or hardware cycles.

- Competition from AI data centers pressures miners’ access to cheap energy.

- Pool software, firmware, and contracts could redirect hash rate without touching Bitcoin’s code.

Bitcoin miners are entering a period of new structural risk tied to power contracts, firmware systems, and hosting agreements as the industry approaches the new year, according to Matthew Case, an independent analyst who tracks mining economics.

In a recent X post, Case described these pressures as forces operating beneath the surface while miners remain focused on the next halving (in 2028) and hardware cycle.

The analyst argued that these vulnerabilities could shape who controls Bitcoin’s hash rate and which companies survive the growing competition for power, while operational chokepoints are shifting from hardware to contracts, software, and energy access.

“As the Bitcoin mining sector eyes 2026, the loudest concerns—halvings, machine efficiency, price swings—are just the surface,” Case wrote. “What’s threatening to reshape the industry lurks beneath boardroom contracts, firmware stacks, and power grid politics.”

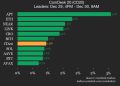

One issue he highlighted was mining pool concentration. Case pointed to a 2025 analysis by Bitcoin developer “b10c” that found that just six pools collectively produced more than 95% of blocks.

“These pools control which transactions they include in or exclude from their blocks,” the post said. “This doesn’t hurt Bitcoin’s censorship resistance as long as these mining pools don’t collude and decide to censor transactions.”

He also explained that lenders, firmware vendors, and hosting providers might influence mining through contracts or management software. If certain conditions are met, hash power could shift without miners doing anything directly.

Case pointed to energy market changes as well. Since 2009 and the launch of the Bitcoin network, miners have relied on power costing less than $0.03 per kilowatt hour, but now these cheap sites are attracting data center operators who are building AI infrastructure, which increases competition for electricity.

Last week, a short-term outlook from the U.S. Energy Information Administration projected wholesale electricity prices rising to about $51 per megawatt hour in 2026, roughly 8.5% above current levels.

Case also said that control over mining firmware and pool software is another weak point because it gives outsiders new ways to apply pressure. He explained that regulators or business partners could influence mining through payout systems or block templates, rather than changing Bitcoin’s main protocol.

“That means regulatory or corporate pressure can target software stacks rather than the protocol itself—forcing KYC, payout freezes, [and] template censorship, all without lifting a regulatory ban,” he wrote.

Case added that it is getting harder to find physical sites. Even if a facility has a fifty-megawatt agreement, it could lose out to someone who offers more money or if the hosting terms change.

“Miners who assume site access is free or indefinitely cheap may wake up in 2026 with stranded host contracts or illegible extension terms,” he said.

Other analysts agreed that while these pressures exist, they pointed out that miners have already adapted to difficult times before. Jesse Colzani, a partner at BlocksBridge, a mining research and consulting firm, agreed that the risks are real, but said the industry is stronger and more energy-focused than the framing suggests.

Colzani explained that mining pools are not permanent bottlenecks because operators often switch pools when payout terms change or there are problems. He said past events show that hash rate can move quickly.

On electricity prices, Colzani pointed out that miners are not limited to one country or region. They can work in areas with unused power or limited infrastructure, where large tech companies are less likely to compete.

“There are a ton of locations with stranded generation, weak fiber connections, and regulatory issues that hyperscalers might not find appealing,” he told Decrypt. “Miners also happen to be the only player willing to ‘eat negative pricing,’ curtail on command, and stabilize renewables. AI can’t do that. So miners will still win deals that AI cannot absorb.”

Despite these worries, Colzani said Bitcoin’s long-term security depends on hash price, energy costs, capital spending cycles, and global involvement, not just block rewards. He noted that hash rate has hit record highs even when fees are low, which shows the market has already adjusted to lower subsidies. He also said that risks like disasters and insurance issues are normal for any industry, not just Bitcoin.

“If AI outbids someone for power, that miner was already on a knife-edge,” he said. “In general, as long as miners have good energy partnerships, behind-the-meter access, and flexible offtake models, they aren’t really competing with AI.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.