Bitcoin traded in a tight range on Sunday, as several major altcoins posted stronger gains, despite the broader macro backdrop remaining dominated by a historic rally in precious metals.

As of 10:35 a.m. UTC, total crypto market capitalization stood at $3.06 trillion, up 0.8% over the past 24 hours. bitcoin rose 0.5% to $87,872, and ether gained 0.5% to $2,939. Among major altcoins, XRP climbed 1.1%, solana advanced 1.3% and rose 1.3%, all outperforming bitcoin and ether over the same period.

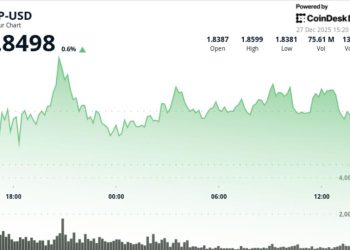

Bitcoin remains range-bound near $88,000

The 24-hour BTC-USD price chart from TradingView (based on data from Bitstamp) showed bitcoin trading within a narrow band. After sliding earlier in the session, price found support in the mid-$87,500s before rebounding toward the upper end of the range near $87,900. Each attempt to push higher was met with selling, while pullbacks were relatively shallow, a pattern consistent with consolidation in thin weekend liquidity.

Crypto analyst Michaël van de Poppe said on X that bitcoin remains stuck between roughly $86,500 and $90,000. He said another test of the lower end of that range would be important because repeated retests can weaken support over time. If buyers fail to defend that area, he said he would next look toward $83,000 and then $80,000 as potential downside zones.

On the upside, van de Poppe said a move back toward $90,000 would be constructive if it also places bitcoin above its 20-day moving average, a commonly watched short-term trend indicator. Regaining that level, he said, could set the stage for a stronger move toward $105,000.

Glassnode’s on-chain levels frame where pressure may emerge

Glassnode posted an update showing that several widely followed on-chain price models have shifted slightly, with spot trading around $87,800. The analytics firm listed short-term holder (STH) cost basis at $99,900, active investors’ mean at $87,700, true market mean at $81,100 and realized price at $56,200.

In on-chain analysis, the short-term holder cost basis is commonly used as a reference for where newer buyers entered the market on average. With spot trading well below that level, many recent participants are underwater, a condition that traders often watch because rallies toward that zone can run into selling from holders looking to exit near breakeven.

The active investors mean sits almost exactly at current spot levels. In practical terms, that suggests bitcoin is trading near a midpoint associated with coins that have been moving more recently on-chain, a setup that often coincides with sideways price action as small moves quickly flip that group between modest profit and loss.

Below current prices, the true market mean, near $81,100, is frequently treated as a deeper valuation reference rather than a forecast, while the realized price, near $56,200, represents the aggregate on-chain cost basis of the entire supply and is generally viewed as a long-term benchmark.

Precious metals rally keeps macro focus sharp

Outside of crypto, precious metals remained in the spotlight as investors continued to gravitate toward traditional inflation hedges amid concerns about long-term purchasing power.

The Kobeissi Letter pointed out on Friday that silver is up roughly 155% year to date, briefly becoming the world’s third-largest asset by market capitalization, while gold is up about 72% this year. The firm compared the move to 1979, when inflation was running at double-digit levels.

Fred Krueger, author of “The Big Bitcoin Book,” who said he is “not much of a chartist,” said on X that he noticed a key line on a bitcoin/silver chart and suggested it raises the question of whether bitcoin could rise 50% while silver falls 50% in the very short term.

In a follow-up post about 15 minutes later, Krueger argued that silver lacks bitcoin’s network effects, saying the more silver spikes, the faster it could fall as the narrative fades. He also said supply could respond in less than a month, starting with scrap metal, and suggested some investors may ultimately ask why they did not simply buy bitcoin instead.